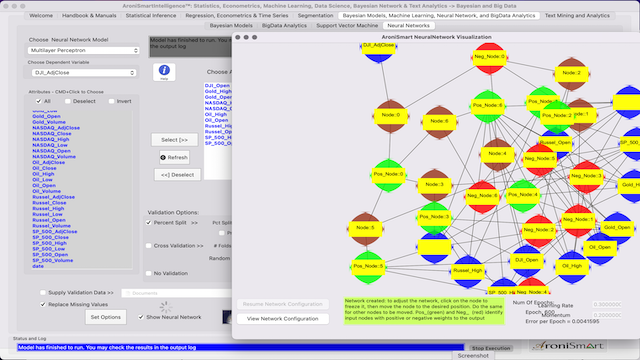

After a fueled momentum over 2021, the stock market has started the year 2022 with volatility. The latest Q3 2021 stock market perfomance figures reminded of the increasing market volatility and other dynamics in late Q1 and early Q2, 2021. Major questions coming from AroniSmartIntelligence™ users have over the 2021 year focused on how to use AroniSmartIntelligence capabilities to analyze the connection among the key Stock market indices, especially NASDAQ vs Dow Jones(DJI), S&P 500, Russell 2000, Gold, and Oil. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Neural Network Analysis of AroniSmartIntelligence™ , has analyzed the trends of NASDAQ and DJI vs the other stock indices (DJI, S&P 500, Russell 2000, Oil, Gold) between early Jan 2021 and early Jan 2022 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website. For related analyses of Stock Markets using Time Series, Dominance Analysis, and Neural Network capabilities see here AroniSmartIntelligence™ in Action: Time Series Support Vector Machine and Neural Network Analysis of Stock Market Indices in Q4 2020 - Q4 2021)

AroniSoft LLC

AroniSmartIntelligence Stock Market Sentiment Machine Learning and NLP Analysis: Market Sentiment and Highlighted Stocks For End of 2021

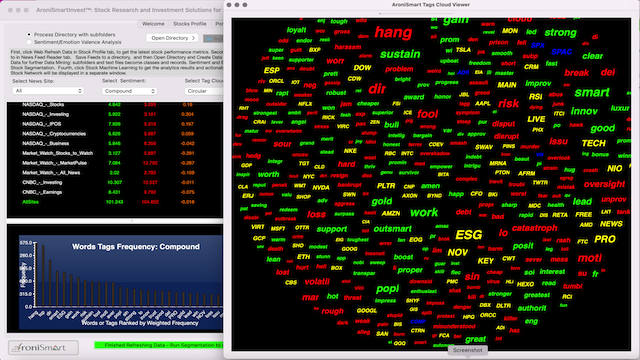

For mid December 2021, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends. The stock market remains volatile, following the news on the new COVID-19 variant, Omicron, the inflation worries, Chinese economic policies, and the projected economic performance for the holidays. From the analysis, the team came up with insights and hilights on key stocks and market sentiments that may drive the stock market for the final two weeks of 2021. Below are the key stocks highlighted and expected to weight heavily in investment decisions in the remaining 2 weeks leading to closing 2021 and the associated sentiment analysis results.

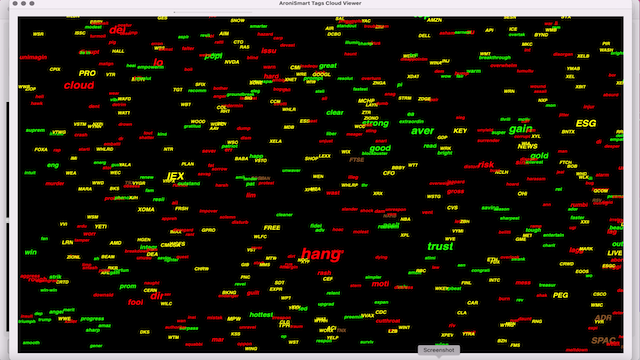

AroniSmartIntelligence Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks on December 6, 2021

On Monday December 6, 2021, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends. The stock market has been volatile, following the news on the new COVID-19 variant, Omicron, the inflation worries, Chinese companies, and the economic performance for the holidays. From the analysis, the team came up with insights and hilights on key stocks and market senttiments. Below are the key stocks highlighted and expected to weight heavily in investment decisions in Q4 2021 and the associated sentiment analysis results.

AroniSmartInvest™ in Action: Key Stocks in November 2021: Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses

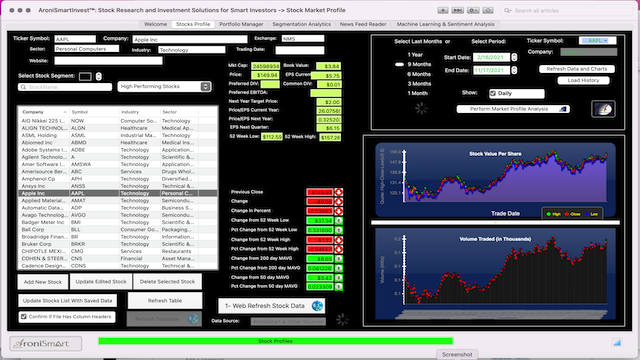

As the end of Year 2021 approaches, the stock market has continued to reach new record highs and to experience new dynamics, on top of the volatility that started in early May 2021. The latest major dynamics are driven by the improving job market, microchips shortages, global supply chain bottlenecks, Electric Vehicles (EV), cyptocurrency, the growing inflation, Chinese government actions on Tech and e-commerce companies, retail and tech companies performance, and the overall economic policies, including the US infrastructure bill.

On November 17, 2021, the key stock market indices remain close to record performances. YTD, the stock indices have performed as follows: Dow Jones Industrial Average gained 22.05%, Nasdaq: 34.91 %, S&P 500: 31.42%, and Russel 2000: 22.15%). AroniSmart™ team, leveraging the Machine Learning, Big Data ,Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™ and AroniSmartIntelligence™, looked at the stock performance, market sentiment index and events driving the stock market as Novembber 17, 2021 and the end of the year approaches ( For More on AroniSoft LLC and AroniSmart products click here). Key stocks driving the market in mid-November 2021 were identified.